Energy Consumers Australia is the national voice for household and small business energy consumers.

We promote the long-term interests of households and small businesses who use energy in Australia by providing and enabling evidence-based advocacy to the energy sector on the issues that affect consumers.

Equity

I pay a fair share of the energy transition.

Value

I pay a fair share for the energy I use.

Agency

I can make optimal energy decisions.

Ownership

I benefit from the energy transition.

Control

I can manage my energy consumption.

Justice

I have the energy I need.

Representation

I have powerful advocates working in my long-term interests.

Our latest work

Consumer Energy Report Card: Understanding and measuring energy hardship in Australia

Submission to the Australian Energy Regulator (AER) on Australian Gas Networks (SA) and Evoenergy (ACT) draft decision and revised access arrangement proposals

Submission to the AEMC's Draft Determination on Customer-initiated gas abolishment and disconnection

Submission to the Australian Energy Regulator (AER) Consultation Paper on Retail Guidelines Review

Latest news

Whipper Snapper is a distillery in Western Australia which, although unopposed to the idea of electrification, had already invested heavily in gas-based distilling equipment that was working well.

What small businesses are telling us about electrification – and what needs to change

Smart meter real-time data decision a win for consumers, ECA says

Gas rule change a significant win for consumers, ECA says

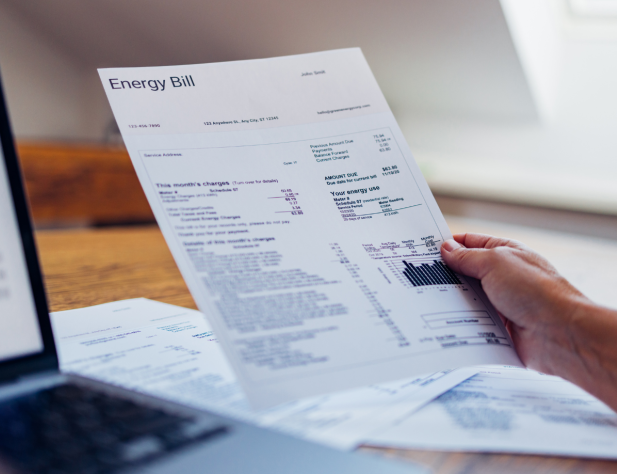

Are you a household or small business?

Check out our information on some of the most common issues and interests that consumers have about energy.

Get helpful resources for: