There’s an enormous contradiction at the heart of how our energy system responds to those who are struggling financially.

And a quick look through the evidence suggests there are likely hundreds of thousands of people, hiding in plain sight, who are not being seen or heard. Not having often-urgent needs met.

As Energy Consumers Australia's Chief Executive Officer Lynne Gallagher observed in December, “We are seeing larger energy debts and more people owing a debt to their retailer. Yet the number of people being placed onto hardship programs by their retailers has fallen significantly – that simply should not be the case”.

To put it another way: Multiple evidence sources are telling us that more and more Australians are struggling with their energy bills and yet fewer and fewer of them are getting help.

Why is this happening? Why does it matter? And what should we do about it?

The scale of hidden hardship

Our December 2021 Energy Consumer Sentiment Survey makes clear that there is a significant proportion of customers who are struggling to pay their bills but are not accessing payment plans or hardship programs.

Since 2016-17, the proportion of residential customers on hardship programs with their electricity retailer has hovered around 1% (for gas 0.6%).1 Over the same period, between 1.3% and 2.5% of electricity customers have been on a payment plan (under 1% of gas customers).

Yet our December survey found 14% of respondents nominated themselves as being under financial pressure -- as opposed to financially comfortable (47%) or able to manage household bills but struggle to afford anything extra (39%).

Other surveys also reveal a significant proportion of Australians who are struggling to make ends meet. The Melbourne Institute found that between April 2020 and April 2021, 20% to 30% of respondents said they would describe their current financial conditions in terms of paying for essential goods and services as “financially stressed”.

Financial stress indicators from ABS Household Financial Resources Dec 2020 survey provide more detailed information, revealing that in the 12 months to December 2020:

- 7.1% of all households surveyed could not pay gas, electricity, telephone or internet bill on time

- 9.7% sought financial help from friends or family

- 4.5% sought assistance from welfare/community organisations

Whichever way we look at it, these figures suggest there is a significant proportion of Australians experiencing financial stress who either aren’t accessing – or can’t access – energy retailer hardship schemes or payment plans. This means they aren’t being captured in the energy sector’s definition of hardship. The industry is dramatically undercounting the number of consumers who regularly endure negative or damaging experiences with this essential service.

It goes far beyond just paying bills

Understanding the true size of this cohort is vital because evidence shows the barriers they face are far deeper than their capacity to pay their bill. The 14% of consumers who self-nominated as being under financial pressure in our ECSS consistently have worse experiences in energy markets and are more likely to struggle participating in them.

It’s probably not surprising that customers under financial pressure are more concerned about paying their bills and are less satisfied with measures such as the cost of electricity than other customers, as the ECSS reveals.

However, customers under financial pressure also report less positive ratings across all other satisfaction measures compared to those who are financially comfortable.

They are less satisfied with overall customer service (63% under financial pressure have a positive rating compared to 76% for those that are financially comfortable), but also with communication (53% compared to 65%) and even with ease of accessing their account (65% compared to 83%).

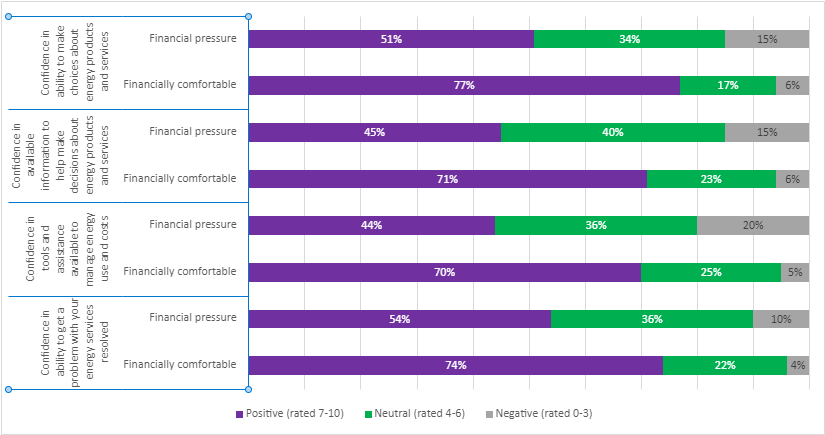

Perhaps most importantly, customers under financial pressure were less confident in their ability to make decisions about their energy plan or provider (and in the support or tools available) compared with those who were financially comfortable. Essentially, those who have the greatest need to shop around and navigate the system for a better deal are those who have the least confidence in their ability to do so.

These factors can quickly lead to disillusionment with an energy system that financially pressured consumers feel does not meet their needs. The ECSS finds only 32% of customers under financial pressure are confident that the energy market is working in the long-term interests of consumers, compared to 51% of financially comfortable energy customers.

Why is this happening?

Recent UK research underlines that people experiencing financial stress find it harder to prioritise and make decisions. More generally, stress is known to impact decision making, including leading to more disadvantageous decision making. For many consumers, the global pandemic that has dominated the past two years has been particularly difficult. The Australian Bureau of Statistics found that in June 2021, one in five (20%) Australians experienced high or very high levels of psychological distress in the previous four weeks. This was consistent with findings in March 2021 (20%) and November 2020 (21%).

As part of the ECSS, researchers did qualitative work listening to the voices of consumers. The impact of stress on decision making came through strongly. As one respondent said:

“I was very sick and overloaded and had limited energy to deal with stuff so I only did stuff if I absolutely had to”

Trust matters

Another area where the ECSS identifies a gap between financially pressured consumers and the larger cohort relates to trust. Just 40% of financially pressured consumers give a positive rating for trusting electricity companies to do the right thing by their customers and by Australia as a whole, compared to 58% of those who are financially comfortable.

Lack of trust and confidence that the energy market is working in their interest may be contributing factors as to why people under financial pressure are generally less satisfied with energy markets, and also, as the ECSS qualitative work once more revealed, why they might be reluctant to reach out to their retailer when they’re struggling:

“I didn’t contact [my retailer] as I wasn’t sure how to deal with it, and I did fear that I would make them want to cut off my power or call the bill in full … You hear stories of people getting cut off and having debt collectors chase them”

“I have found in the past with other services, once you flag difficulty to pay once, it puts a red flag on your account”

This lack of trust has serious consequences. The ECSS suggests that when customers do ask for help from their retailer, the majority have a positive experience – although retailers have some room for improvement. Around 40% of customers under financial pressure reported asking their electricity provider for help managing their bills. Of these, three quarters said they received help that was useful, with one quarter reporting they did not receive help that was useful.

What can we do?

As an industry, we need to find better ways to identify and support these customers. The range and complexity of energy options will only increase as we shift to greater participation by consumers in energy markets. The challenge for industry is to help all consumers navigate both current and future markets by reducing complexity and building trust.

Building an inclusive energy market will require us to reframe our thinking about consumers who are vulnerable to energy hardship. As the Consumer Policy Research Centre pointed out in its 2020 report for the AER, rather than looking to see ‘what is “wrong” with this person?’, industry and the regulators should ask, ‘what is wrong with the service if a person cannot access it?’

More needs to be done by retailers to earlier identify customers who are struggling and offer them assistance. The Australian Energy Regulator (AER) found in its Annual Retail Report that the average electricity debt for a customer entering a retailer’s hardship program had increased by 21% between 2019/20 and 2020/21, from $1,304 to $1,584. Help needs to be offered much sooner than that.

Customers able to access help through their retailer’s energy hardship programs can be offered relief. But the evidence is clear that this is only a small proportion of the total number of people experiencing financial stress. Retailers also need to consider options for supporting customers who are struggling to pay their bills and engage in the market, before they need or are eligible for hardship or payment schemes. These options need to be simple to access and easy to understand.

And we need to improve people’s confidence in the tools and information available to help them compare and switch plans and retailers. Tools that are simple to use, and information that is easy to understand and bespoke to individual customers and their needs, will help improve customer confidence.

The AER’s Draft Customer Vulnerability Strategy provides a helpful framework and process for exploring some of these issues. The AER has developed a working definition of customer vulnerability that rightly encompasses a broader cohort of people than simply those that have energy debt, acknowledging that consumer vulnerability can stem not just from financial pressures, but from the complexity of the energy market and personal circumstances including disability or poor mental health.

We look forward to working with the AER on the objectives and actions outlined in the Strategy that will, among other things, seek to improve outcomes for vulnerable consumers. We encourage retailers and other industry players to engage in the AER’s process.

Customers under financial pressure are already largely dissatisfied with most energy market measures, compared to those who are financially better off. As we transition to a smart and modern grid, the complexities of engaging with energy markets will only increase. We can’t allow a situation where an already-deficient approach to hardship becomes even more exposed and fragmented, leaving those who already have difficulty navigating energy markets even further behind.