Key Findings

The results for our inaugural October 2021 survey shows COVID-19 has caused Australians to make significant changes in how they use energy and the decisions they make around it.

- 59% say they are cooking at home more.

- 40% say their house uses more heating and cooling since the pandemic.

- 52% say their household has more digital devices running than 5-10 years ago.

- 42% say their kitchen has a wider variety of appliances than 5-10 years ago.

And while Australians are reporting they’d like to use less energy, confidence in doing so over the next 5-10 years is mixed.

- 24% of respondents think their house will use more cooling during that period.

- 17% think their home will use more heating.

- 29% think it likely or certain they will use air conditioning to keep a pet comfortable or healthy.

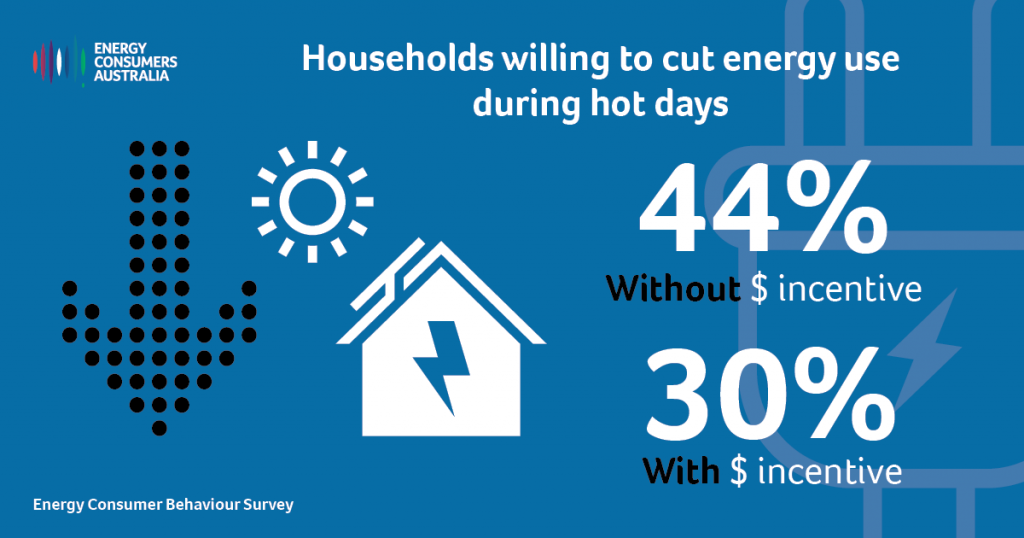

Are consumers willing to reduce or shift their energy use when demand spikes?

- 30% said they would reduce energy use "as much as possible" only if there was a financial incentive

- 44% said they would, even without a financial incentive.

- 8% said they would be unwilling to take action.

When asked to change their energy use only “a little”:

- 32% said they would do so only if offered an incentive

- 47% would do it without a financial incentive.

When we surveyed consumers about switching from gas to electricity, the results showed:

- 9% of household consumers said they were seriously considering running their home on electricity only.

- 77% either had not thought about it or had decided not to.

For small business consumers these numbers were higher:

- 27% said they were seriously considering converting from gas to electricity.

- 30% reported they are considering it but not seriously.

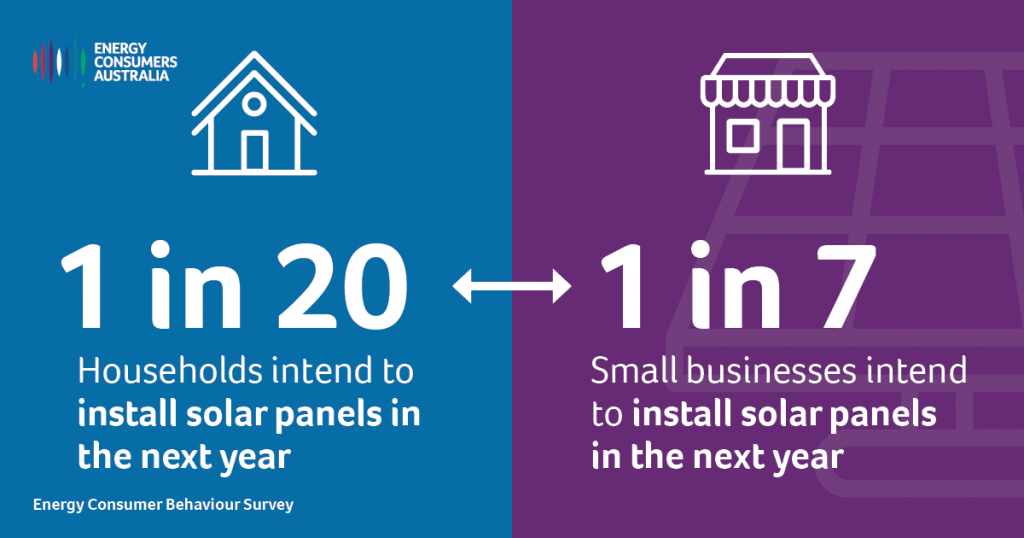

The past decade has seen a rapid rise in the uptake of energy technologies or Distributed Energy Resources (DER).

- 28% of respondents who say they own solar panels.

- 5% of respondents say they intend to buy solar for their household in the next 12 months

- 15% say they will consider buying solar panels in the future.

- 3% of respondents said they were planning to buy a home battery in the next 12 months

- 21% are interested in purchasing a home battery in the future.

- 2% of households reported purchasing an Electric Vehicle (EV) during the past 12 months

- 3% are planning to purchase an EV in the coming year.

- 18% of respondents say they will consider purchasing one in the future.

- Of those considering an EV, 60% would do so for environmental reasons, while 38% nominated financial reasons.

Page last updated:

03 April 2025