At Energy Consumers Australia we look for evidence of what consumers want, need and value and bring that evidence to bear on the big questions around how the energy system works (or sometimes doesn’t).

Sometimes the evidence can get… interesting. Take the curious case of energy affordability.

For much of the past decade, affordability has been a huge concern for households. According to our June Energy Consumer Sentiment Survey (ECSS), four times as many people view affordability as the most important issue for the future energy system than do reliability.

It’s not hard to see why. In recent years we’ve seen overinvestment in poles and wires (colloquially known as gold plating) drive energy bills for households and small businesses to historically-high levels. People responded with concern and anger. Measures were introduced, by governments, regulators and others, to try and reduce prices for consumers.

What’s happening now

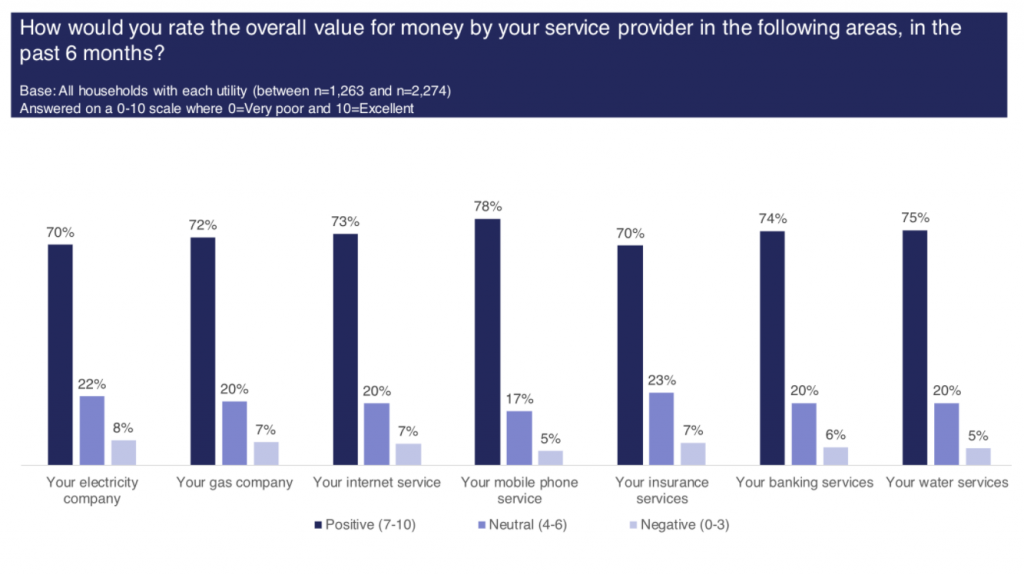

More recently we see a rather different picture. Our most recent ECSS found satisfaction with affordability had surged. The survey found 70% of respondents felt they were receiving good value for money with their energy bills – a jump of 13%.

At around the same time, the ACCC released its Inquiry into the National Electricity Market in late June, showing household energy bills rose by seven per cent from the previous year.

After years of talking about “bill shock” here was a curious phenomenon. Bills rose appreciably for almost all Australian households but consumer sentiment about value for money jumped by an even larger amount.

The reason for rising bills, of course, was Covid-19. While household bills increased by 7% household average energy usage actually jumped by 10%. Wholesale energy prices have fallen but households are receiving higher bills because, stuck at home, working and playing at home, they are using more energy.

Perhaps, being homebound during the pandemic, consumers have become more aware of their home energy use and how vital it has been to preserving their way of life at a difficult time. More emotionally connected to their use, and aware of its centrality to their lives, they valued energy more and had a background awareness they were using it more as well.

Why is this interesting?

Perhaps because it shows that consumers are a bit more sophisticated than we often give them credit for. Householders do not simply look at their bill and set their satisfaction level accordingly. They mostly don’t track wholesale energy prices or compare how many kWh they consume from month to month. But they do have an unerring sense – a kind of wisdom of crowds – that often makes them right about the big things.

How is this wisdom formed? Consumers are reading the news, they’re talking to family, neighbours and friends, they scan social media feeds or talkback radio. When seeking to understand what consumers are feeling and why, it’s a good idea to look at the stories that are circulating in the broader community beyond energy.

For the past two years, consumers have been receiving messages about competition, lowering energy prices and increased oversight. The ACCC’s 2018 Retail Electricity Pricing Inquiry discovered a lack of competition in the market and since then, we’ve seen a number of core reforms which have influenced the conversation.

The Commonwealth’s ‘big stick’ legislation in 2019 not only came with a catchy name, it sent a clear signal to consumers that affordability was a priority within current energy policy. It promised significant consequences for failing to pass on cost savings to consumers and added to the sense that there was real pressure for energy companies to keep prices down.

The introduction of the Default Market Offer (DMO) in 2019 also promised a tangible improvement to how consumers navigate a complicated market. Entering its third year, the DMO has resulted in reduced energy bills for consumers on both standing and market offers but perhaps most significantly, it has offered up a vital tool for those willing to shop around.

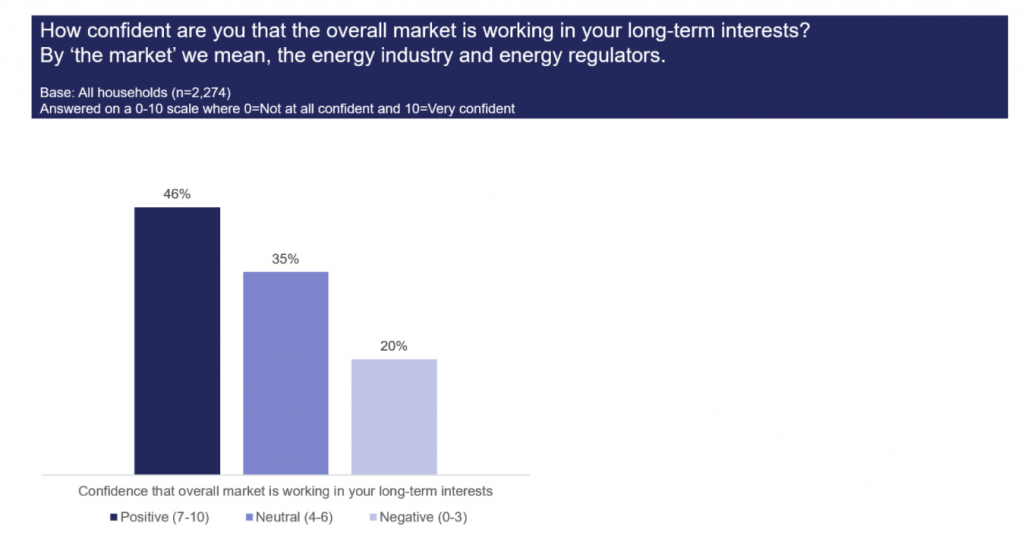

The same ‘wisdom of crowds’ reasoning could also be given to another peculiar insight gleaned from the recent ECSS. With frequent discussion about the lack of trust consumers have for their retailers, it’s somewhat of a surprise that 46% of respondents believed the market was acting in their best interest (up 10% from the previous survey).

Again, we might turn to Covid-19 as we try to figure out why consumers are increasingly trusting the market. Instead of stories about dodgy deals and untrustworthy retailers, perhaps they’ve been exposed, in one way or another, to stories about how energy companies have been moderating their behaviour.

In 2020, the AER released their Statement of Expectations of energy businesses which required providers communicate more with customers and provide additional support to those experiencing financial hardship. Whether everyday Australians heard about it, or experienced the benefits first-hand, increased communication and support is a sure-fire way to build trust.

Why this is important

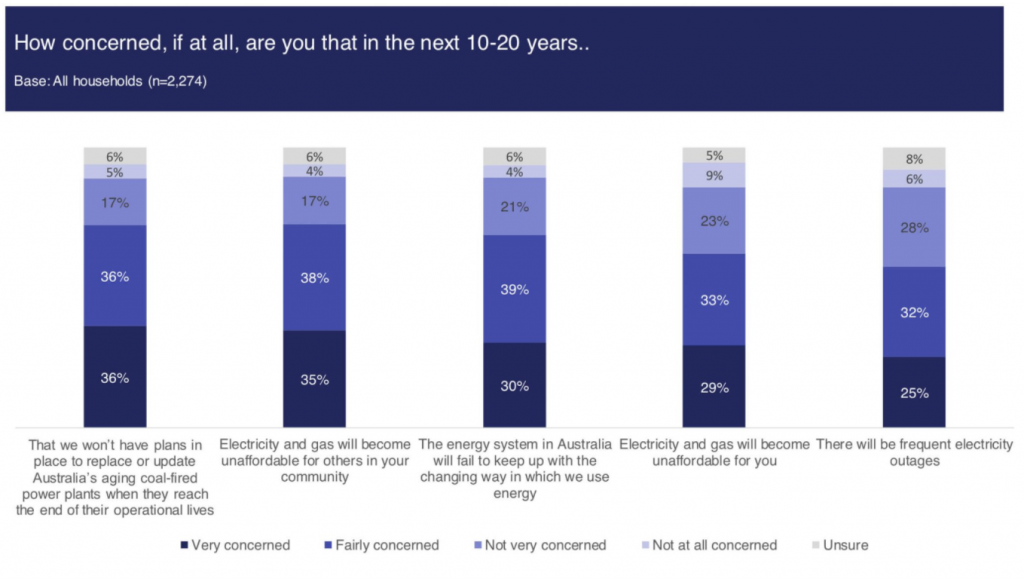

If we assess that consumers get it right more often than not when it comes to the big changes in energy there might be cause for concern. Because while the ECSS shows that consumers are broadly satisfied with current energy affordability, it finds them far more concerned about future affordability. The survey found 62% of respondents were concerned about being able to afford electricity or gas in the next 10-20 years and 73% were concerned about affordability for others.

Where is all this concern for the future coming from? Consumers have seen numerous significant projects announced, discussed and mooted, with questions often following about how they will be paid for. In NSW alone recently, we’ve seen the Snowy Hydro 2.0’s budget increase beyond $5 billion, plans for Renewable Energy Zones announced and the announcement of $2.28 billion for Project Energy Connect.

These projects are frequently accompanied by the promise of improved reliability for our transitioning energy system. But is this all that consumers want to hear? Might they also like to know how these projects’ big budgets will impact their energy bills? And if they don’t hear answers might they fear the worst?

Some, perhaps even many, of the investments being considered or announced may be necessary and positive interventions for our energy system. Too often, though, consumers are left wondering whether more investment is necessary and what it might actually mean for their energy bills.

Pay attention to the signals

Consumers are signalling that affordability is both their priority and their fear. They’ve also shown that they are tuned in to what’s happening in the world of energy and can shift their thinking when positive changes are introduced.

So what is being done to ensure that the focus on accountability and affordability we’ve seen in current times transfers to the future? Who is listening to consumers’ concerns and using them to inform the direction of future energy policy? Consumers, more savvy than we often give them credit for, are perhaps aware of this absence. Who is looking out for them?

As a sector we need to get better at listening to the concerns and desires of consumers. Their worries about the future are based on real issues and are a dynamic response to the information swirling around them and the life experiences they go through each day. When they are concerned, energy leaders and actors should be concerned also. Research like the ECSS constantly throws up surprises and is a helpful reminder that consumers are always talking, if you can just learn to listen out for them.