In the National Electricity Market, most households can choose their electricity retailer.

According to economic theory, this level of choice should foster competition, where electricity retailers compete by lowering prices or offering tailored products to meet the specific needs of their customers. Yet in practice, consumer behaviour often diverges from theory.

The ACCC has found evidence of a “loyalty tax”, with customers on plans older than two years are paying on average $317 more a year than those new offers. Yet, despite years of economic reforms aimed at increasing transparency and simplifying plans, many consumers still don’t switch that often.

Are these problems unique to the electricity industry, or are they reflective of broader trends in essential service markets? Understanding these behaviours is vital for policymakers. If consumers aren’t engaging—even when plans are simpler—then we must rethink how competition policy and regulation can deliver fairer outcomes for all households.

Many Australians aren't regularly searching for better offers, regardless of the market

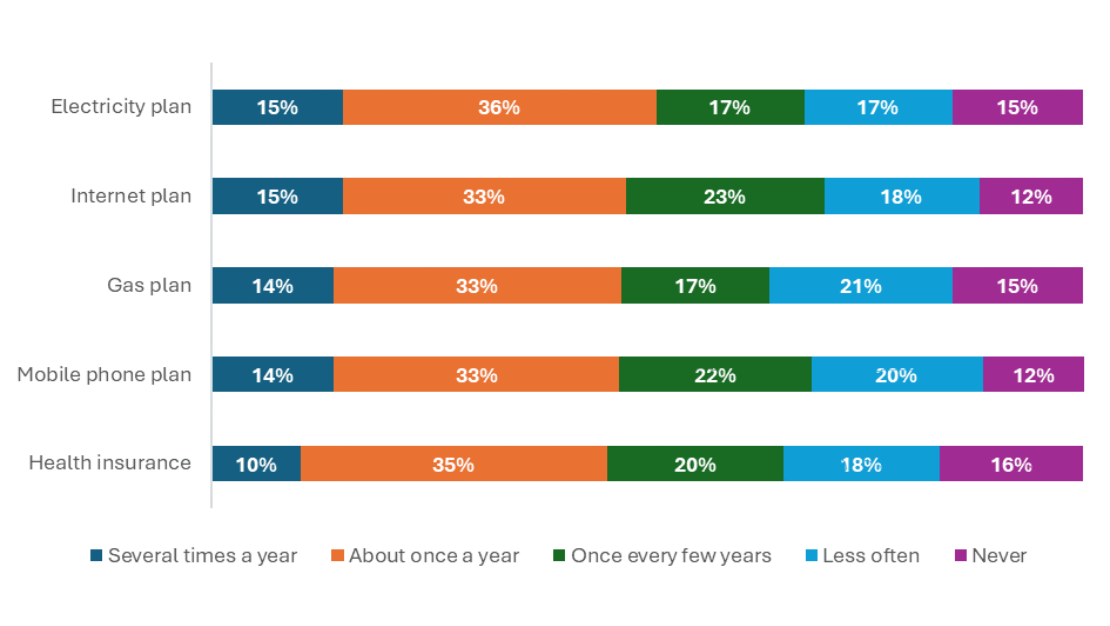

Figure 1 shows around one in three Australians say they look for better utility plans about once a year. Just 10 to 15% are highly engaged, looking around several times a year. This pattern is consistent across energy, mobile phone, internet and health insurance.

In contrast, around one in three Australians say they look for a better plan less than once every few years – or never at all. Again, this is consistent across all utilities, telling us that a large proportion of Australians are not interested in frequently switching plans.

The findings suggest that people have similar switching behaviours across all utilities. In other words, if someone searches frequently for better electricity plans, they are likely to do the same for internet or mobile. The opposite is true for those who never search for plans.

Figure 1 - How often people say they search for better offers or plans

Source: SEC Newgate on behalf of Energy Consumers Australia, September 2025.

Many Australians find utilities difficult to understand

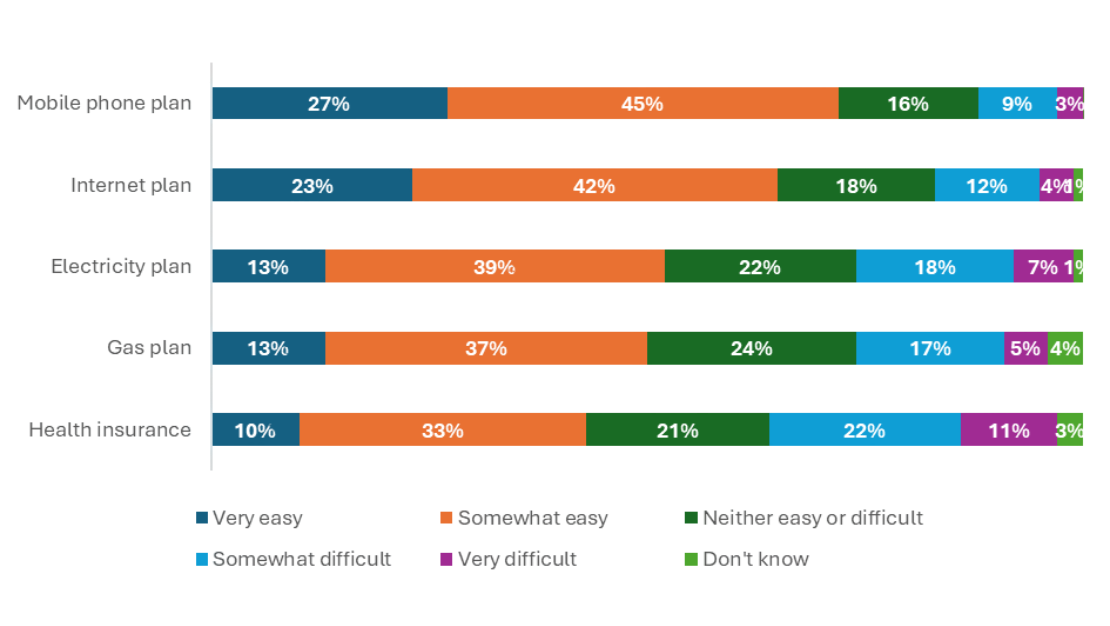

Complexity is often cited as a barrier to switching. It’s true that electricity and gas plans, with their mix of fixed and variable charges, are harder to compare than mobile or internet plans, which typically use fixed monthly billing.

Figure 2 shows, as expected, Australians find it easier to understand mobile phone and internet plans than they do electricity and gas plans. That said, only around 1 in 4 Australians say they find mobile phone and internet plans very easy to understand.

Figure 2 - How easy or difficult people find it to understand plans or contracts

Source: SEC Newgate on behalf of Energy Consumers Australia, September 2025.

Rethinking policy and regulation goals

Our results show that while Australians find internet and mobile phone plans easier to understand, this doesn't lead to higher engagement.

Instead, switching behaviours appear to be driven by individual characteristics – some people shop around a lot, others don’t.

For policymakers, these findings may challenge some long-held assumptions. It's long been assumed that if we make plans simpler and provide better information, consumers will become more active, driving competition and better outcomes. But the evidence suggests otherwise.

"It's long been assumed that if we make plans simpler and provide better information, consumers will become more active, driving competition and better outcomes. But the evidence suggests otherwise."

While we've focused on engagement and switching rates here, these shouldn't be ends in themselves for policymakers. For instance, high switching rates may indicate a broken market or poor customer service. Conversely, low switching may reflect stability and trust.

Instead, policy should focus on outcomes – affordable, fair and high-quality services for all Australians. It isn't equitable for loyal, longstanding customers to subsidise heavily discounted offers for new customers.

As a way forward, we're exploring a new approach to regulation—one that places responsibility on retailers to deliver good outcomes for consumers through an overarching consumer duty. This outcomes-based framework is designed to ensure that all Australians benefit from essential services, regardless of how often they engage with the market.

For updates on this work and how to get involved, subscribe to our newsletter.

Subscribe to our newsletter

Join our community to access analysis on energy events, be the first to see our latest market research, receive invitations to stakeholder events, and help advance consumer needs.