Six months ago, when we released our last Small Business Retail Tariff Tracker report, it painted a pretty grim picture of what was occurring in the retail energy market. Average energy bills for small business had increased significantly and the shocks to the wholesale market were having detrimental impacts on the retail market and consumer outcomes. The number of retailers with available market offers was down, retailers were raising offers far and above the regulated Default Market Offer price, and some were even encouraging their customers to leave and find a better offer elsewhere.

We are by no means out of the woods, and you would be hard pressed to find a positive news story on energy at the moment. This is further emphasised by the announcement from the Australian Energy Regulator in their May DMO Determination that small businesses on standing offers will see their annual bills rise by up to 29% from 1 July. In Victoria, the Essential Services Commission has made a similar announcement, with standing offer prices set to rise by on average 25% for small businesses.

However, at least in the last six months, there are signs the unprecedented volatility that began last year has cooled somewhat. Our latest Small Business Retail Tariff Tracker report finds that, while bills are still high compared to a year ago, in the past six months we have seen a slight improvement in retail market outcomes.

Discover all the results from the latest Tariff Tracker

Advertised market offers have decreased compared to six months ago

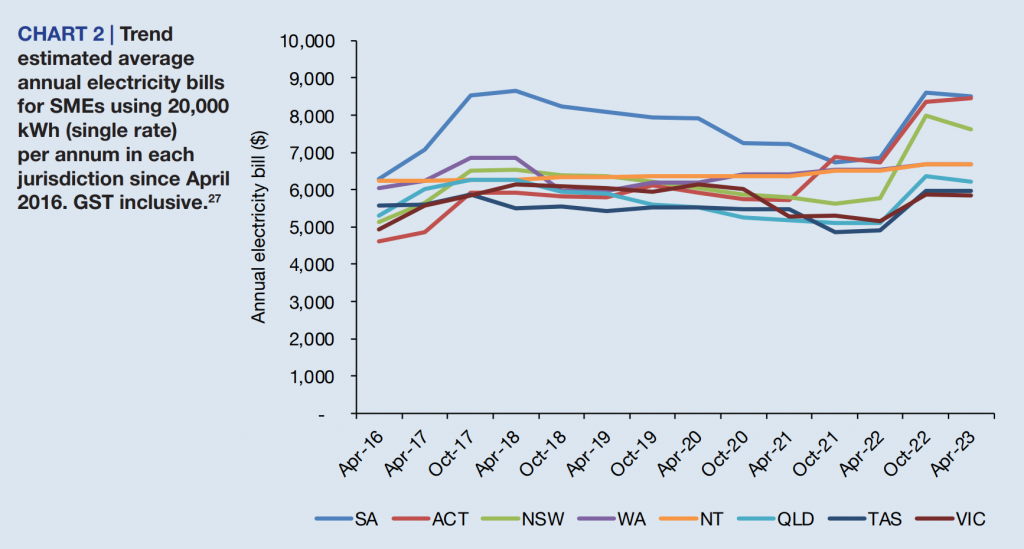

Compared to the same time last year, the average annual electricity bill for SMEs consuming 20,000 kWh per annum has increased by 18%. This varies significantly by jurisdiction with some, such as NSW, experiencing much larger increases (32%) while others like WA seeing smaller increases (2%).

However, in the last six months, several jurisdictions have seen average bills level off or decrease. NSW, which experienced the largest year on year increase in the last 12 months, saw a drop of 5% between October 2022 and April 2023.

There’s a number of reasons this may be the case, with one being the wholesale market somewhat stabilising, at least for now. This is having an impact on the retail market, with signs that the unprecedented behaviour we saw from retailers last year is easing.

For a quick snapshot of what is occurring in each state, we have developed specific national, state, and territory fact sheets to breakdown the information.

Signs of competition have also improved

Six months ago, we saw a dramatic decline in the number of retailers with advertised market offers. While still down compared to a year ago, our June report reveals that several retailers have re-entered the market since October. For example, Momentum Energy, which had no advertised offers in Victoria in October, has re-entered and now has the cheapest offer of all Victorian networks.

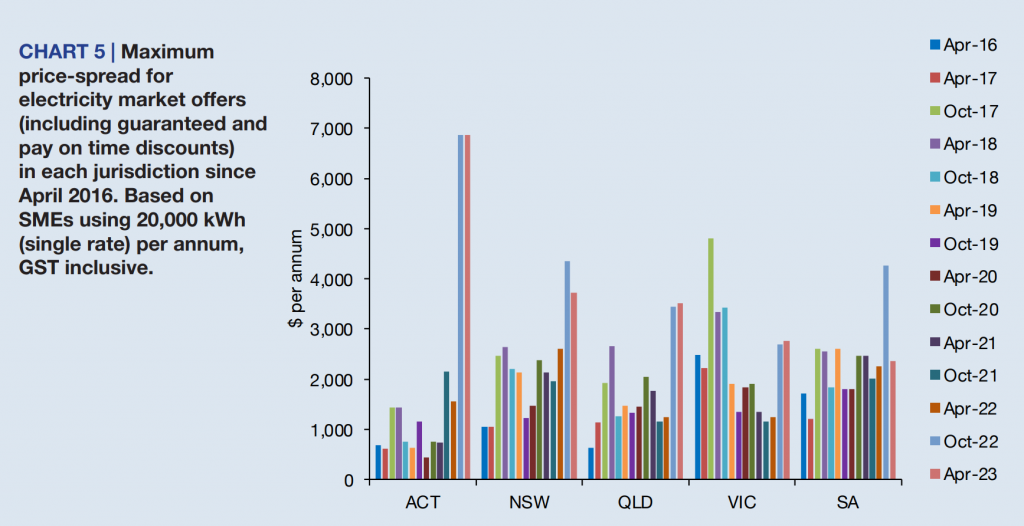

In our last report, we drew attention to how a greater difference between the best and worst offer (price spread), normally a sign of healthy competition in the market, was actually the result of some retailers introducing offers so high they were effectively pricing themselves out of the market.

Seeing price spread decreasing in some jurisdictions in the last six months is not necessarily a cause for concern and is instead a result of some of these much higher offers coming down. This is the case in NSW where CovaU’s offer, which was significantly higher than the DMO six months ago, is now priced below the DMO in all networks.

What this tells us is that, as volatility in the wholesale market eases, so too do the reactions from the retail market. An increase in market offers and a reduction in some of those abnormally high outliers signals that, although prices are still high, there is potentially a more predictable environment to operate within.

Find out more about the full Tariff Tracker results

Eye of the Storm

Six months of slightly eased pressure on the retail energy market is cause for a moment’s optimism. However, these results should be interpreted with a degree of caution. We know from the AER’s announcement that we will be seeing a significant rise in electricity bills come July and our June report doesn’t capture this. We also know that, despite positive signs in the past six months, average bills are still up significantly compared to where we were a year ago.

For our June Small Business Retail Tariff Tracker report, we also collected and analysed bills from a number of small businesses in different jurisdictions. From these case studies we can see how changes to energy bills are directly affecting the businesses who pay them. In NSW, for example, a swim school in the Endeavour Energy network pays around $25,120 on electricity a year and experienced a 25% increase in September last year. If their market offer goes up again by the same amount the AER has announced standing offers will increase in their network, the swim school will be paying an additional $6,280 for the year.

Rather than take these results as an indication that all is well, a period of less dramatic movements offers up a chance to think about how we can equip small businesses with the tools they need to deal with a prolonged period of high energy prices.

What help is available to small businesses?

We know from our Energy Consumer Sentiment Survey that small businesses don’t feel they have the tools they need to manage rising prices. Calls to shop around for cheaper deals, while they may work for some, feel like they offer false hope when the last 12 months have seen offers increasing across the board. A hairdresser in Victoria’s Jemena network, despite being on one of the worst available offers, would only save about $130, or 5%, by switching to the best offer for them. And while any potential savings are worth investigating, switching is not a magic bullet but needs to be considered as part of a range of options to bring about bill relief.

The Commonwealth’s Energy Bill Relief Fund offers some recognition of the cost challenges that small businesses are facing. The announcement that certain businesses will receive up to $650 in energy bill relief will look different for the eligible businesses we looked at in our case studies. For the swim school in NSW, it will shave 2.7% off their annual bill while a printing business in Western Australia will see their bill reduce by 19.3%.

Read more about these businesses in our dedicated Case Studies Fact Sheet. (PDF, 86.15KB)

While our Tariff Tracker project can help us to understand the overall changes we are seeing to energy bills, these case studies remind us that higher energy bills are a reality that many small businesses will struggle to absorb. The energy environment they are operating in may not feel quite as volatile as a few months ago, but it is still a difficult one with little reprieve in sight. Support for small businesses as we head into another year of price increases will be as important as ever.

For more information about how small businesses can save money on their energy bills, visit our Consumer Advice Hub which includes specific advice for small businesses.