Every time you ask ChatGPT a question or stream your favourite show, large data centres full of servers are consuming huge amounts of electricity.

These data centres are essentially large warehouses dedicated to housing computer systems and equipment that stores, processes and distributes data. They’re the hidden infrastructure of our digital world that people are increasingly relying on, and they could fundamentally reshape Australia’s energy landscape — as well as your electricity bill.

Right now, data centres consume about 2% of the electricity in Australia’s National Electricity Market (NEM). That might not sound like much just yet, but that figure is projected to grow to 12% by 2050.

Are you an individual or non-profit keen to research the impacts of data centre growth on Australian households and small businesses? Submit an expression of interest in one of our Influence grants to receive funding for your research.

Access funding for data centre research

Aerial photo of a data centre in The Netherlands. Source: iStock

Data centres are getting bigger

Not all data centres are created equal. While traditional facilities handling cloud storage and streaming services have been around for years, we’re now seeing the rise of “hyperscalers” — massive, single-organisation facilities designed specifically for artificial intelligence (AI) training, such as large language models like ChatGPT (OpenAI) and Claude (Anthropic).

The largest data centre in Australia today, AirTrunk’s SYD1, uses 130 MW to run and cool its central processing units (CPU) and graphics processing units (GPUs). SYD3 is being built as a hyperscaler data centre and would use 320 MW. This would be about a third of the electricity demand of Tomago Aluminium smelter, which is currently Australia’s largest single electricity user.

CSIRO’s high performance GPU cluster. Copyright: CSIRO Australia

How data centres can affect consumer electricity bills

International evidence paints a sobering picture. Analysis by Bloomberg finds that wholesale electricity costs are as much as 267% higher today in areas near data centres than five years ago, compared to more modest increases in other areas.

In the state of Virginia, USA, it is estimated that unconstrained data centre growth would add $40 USD to monthly household electricity bills by 2040.

In Ireland, data centres have been responsible for 88% of increased electricity demand from 2015 to 2024. By 2030, 30% of Ireland’s demand is expected to come from data centres, “placing upward pressure on electricity prices” due to the need to purchase additional generation capacity.

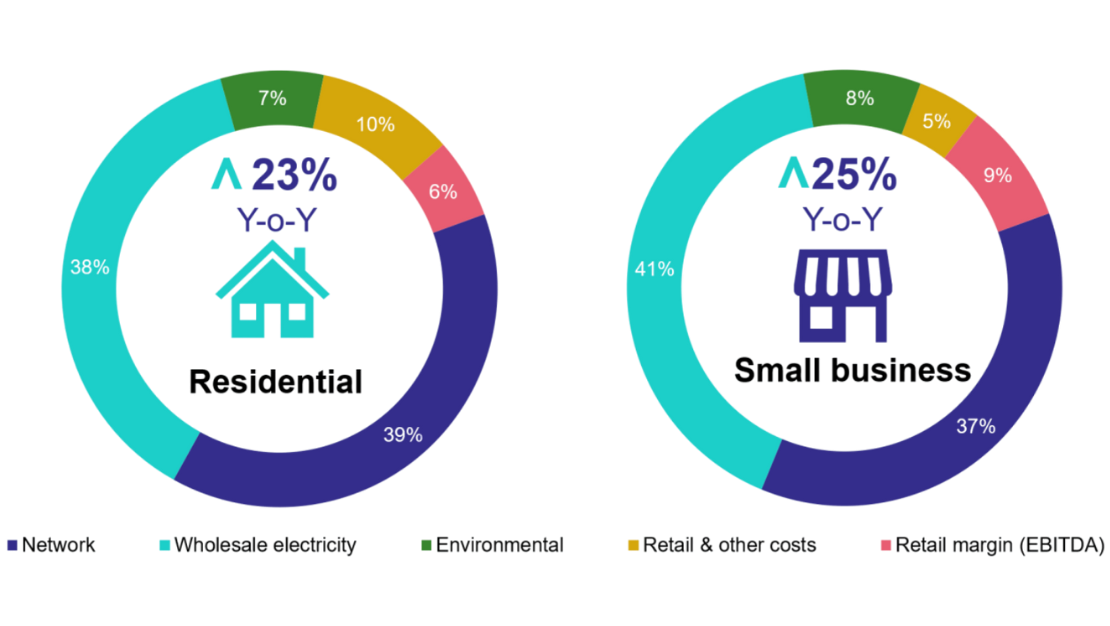

In Australia’s National Electricity Market (NEM) today, electricity network costs make up almost half of household electricity bills, and these costs are rising. The rapid growth of new data centres has driven increases in peak electricity demand, requiring some network upgrades, contributing to these cost increases.

The question is, who should pay for these upgrades? Major electricity users like factories and paper mills usually pay upfront to connect to the electricity grid. But how these connections are categorised by the Australian Energy Regulator (AER) and electricity networks, affects whether everyday consumers end up shouldering the cost of maintaining the network.

ACCC analysis of retailers’ data for 2023-24. Source: ACCC - Inquiry into the National Electricity Market (2024)

As well as affecting network costs, data centres can affect the wholesale price of electricity — the price paid in the electricity market before it reaches consumers — and the costs of keeping the electricity system stable. With data centres adding near-constant demand for electricity, wholesale electricity prices rise for all consumers. During times when electricity demand is at its highest and available supply is limited, this effect may be particularly strong.

Any health or emissions reduction benefits that may be made from renewables coming online, are being sucked up by new sources of demand, such as large-scale data centres. Professor Hannah Daly put this best:

"We are simply funding renewables to meet new huge sources of energy demand that data centres represent. It's like running up a down-moving escalator, growing renewables, but not cutting fossil fuels."

Keeping the electricity system running smoothly adds another layer of complexity and potential consumer impact. A data centre’s electricity demand can change rapidly in ways that are difficult to predict. If the Australian Energy Market Operator (AEMO) can’t see electricity demand from data centres in real time, this could drive up the need for frequency control and ancillary services (FCAS), which someone has to pay for.

In general, the costs to provide FCAS are recovered from those who create the need, such as a large electricity user. But given the potential impact, regulators will need to ensure these cost recovery mechanisms adequately capture data centres’ impact on grid stability.

Not all electricity is created equal

There’s an important difference between data centres and other growing electricity demands like electric vehicles (EVs). EV charging can actually reduce electricity costs (PDF, 5.86MB) by improving how electricity is used across the network and throughout the day. People charge their EVs when it’s convenient, spreading demand and making better use of existing infrastructure.

Data centres, on the other hand, are more likely to run constantly at high capacity, and their flexibility is questionable.

In Virginia, for example, 60 data centres simultaneously disconnected from the grid and switched to backup power during a system disturbance, creating an unexpected loss of demand that required the grid operator to rapidly power down electricity generators. The Australian Energy Market Commission (AEMC) is trying to proactively address this issue through a change to the National Electricity Rules, making now a particularly important time to understand the problem and find the best path forward for Australia.

Help us answer critical questions about data centres for consumers

Rigorous, independent research is needed to understand exactly how data centre growth will impact Australian households and small businesses. Some of the questions Energy Consumers Australia is interested in include:

- What are the real electricity bill impacts under different data centre growth scenarios for consumers?

- How can we ensure that data centres pay their fair share?

- What policies would incentivise data centre owners to provide grid services such as system strength that offset their impact?

Energy Consumers Australia is calling for expressions of interest for our Influence Grant program and this is one area we would welcome applications for.

If you’re a researcher or non-profit with the capacity to dive into issues that impact residential and small business energy consumers, we want to hear from you.

The evidence from Australia and abroad poses timely questions about how our electricity resources are used and shared, and who pays for what. Consumers deserve to know their interests are being represented in discussions that could significantly increase their energy bills, both now and into the future. We look forward to elevating this discussion in the minds of energy decision-makers and the broader public with your help.

FAQs

Data centres are large warehouses dedicated to housing computer systems and equipment that stores, processes and distributes data.

The Australian Energy Market Operator (AEMO) operates the National Electricity Market (NEM). This includes forecasting the impact of growing sectors, such as data centres, on the electricity system. Here you can read about how AEMO is updating its forecasting methodology to accommodate large electricity loads.

Frequency Control and Ancillary Services (FCAS) are backup tools that help keep Australia's National Electricity Market safe, secure and reliable. Find out more at the Australian Energy Market Operator's website.

Our Grants Program supports not-for-profit organisations and individuals to pursue advocacy initiatives that prioritise and progress household and small business consumer interests in the National Electricity Market.

Our Influence Grants support advocacy initiatives with a purpose of immediate influence on a specific and achievable goal on matters of material significance to residential and small business consumers.

Find out more about available grants and how to apply.