How big an impact on your electricity bill does switching lights off when you leave a room, using cold water to wash your clothes, or turning off appliances at the power point make?

Answers to questions like these are at the heart of what might motivate consumers to reduce their electricity consumption.

And information about energy consumption is becoming increasingly accessible to consumers with the uptake of smart meters across Australia.

Where old accumulation or interval meters can only indicate the total accumulated electricity usage over a billing period, a smart meter can provide usage information at 30-minute intervals, accessible through an app on a phone or computer.

If a consumer turns the heater down in May, to try and save some money, but has to wait until August to see if it made a difference to their bill, they are less likely to see the direct correlation between energy-saving behaviour and dollars saved. Smart meters have the potential to help consumers access electricity usage in near real time with a few clicks on an app or website. This can create a clear link between energy-saving behaviour and money saving results. Consumers are much more likely to feel a sense of reward for changing their behaviour.

But uptake of smart meters has not happened as quickly across Australia as most experts expected. (Some possible reasons for this are explored HERE).

The Energy Consumer Sentiment Survey (ECSS), released in June 2021, explores this important issue further by examining how consumers feel about being able to access more and detailed information about their electricity usage.

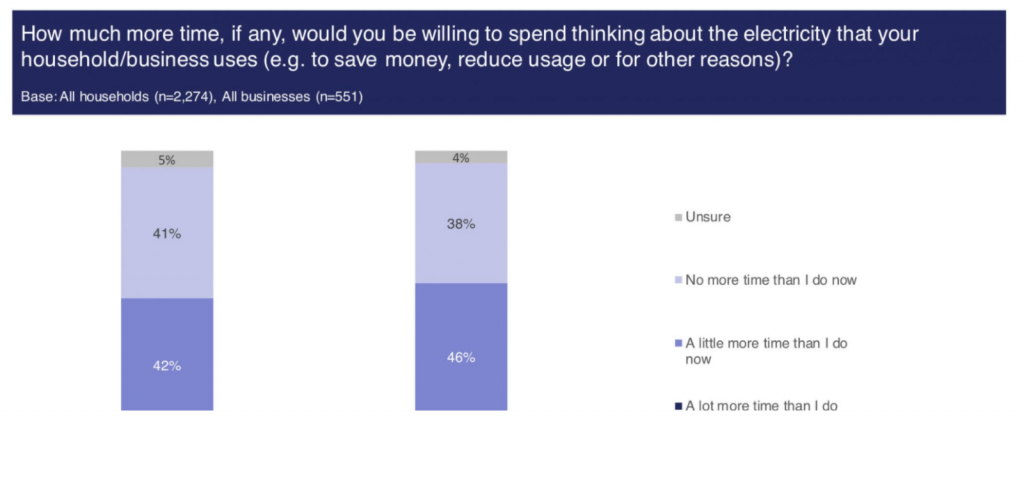

More than half of Australian households and small businesses say they currently do not spend much time thinking about their electricity usage. Interestingly, however, this is not because they are unwilling to do so. Over 50% of households and small businesses indicate they would be willing to spend at least a little more time -or even a lot more- thinking about their electricity use if it meant they could save money, reduce their usage, or for other reasons (Figure 1).

More than half of Australian households and small businesses say they currently do not spend much time thinking about their electricity usage. Interestingly, however, this is not because they are unwilling to do so. Over 50% of households and small businesses indicate they would be willing to spend at least a little more time -or even a lot more- thinking about their electricity use if it meant they could save money, reduce their usage, or for other reasons (Figure 1).

If consumers are willing to spend more time thinking about their electricity usage it should be incumbent on energy retailers to make it easier for consumer to do so. That should involve ensuring that the information consumers receive is useful, easily accessible, and digestible and will help them achieve their energy goals. Since every customer is different, this may mean targeted and individualised information.

Results from the ECSS show that the information consumers would find most useful is an overall measurement of their energy usage, followed closely by the breakdown of energy consumption for different appliances in the home. Consumers are less interested in information about how much electricity is used on average by people in similar homes, or in receiving information about electricity usage per room.

Which consumers are most interested in this information?

Consumers who indicated that they currently do not spend much time thinking about electricity were more likely to be older, more financially comfortable households. Those who are currently spending more time thinking about their electricity are likely to be households with dependent children. These households were also more likely to want to spend even more time doing such thinking in the future.

Understanding which groups of consumers may be interested in receiving more information about their energy use is important to consider when designing apps or tools to be used for this purpose.

For example, households with dependent children, who are willing to spend more time thinking about usage in the future, are also often the most time poor. Not all consumers have the time or are interested in scrolling through pages of data and predicted calculations about their energy usage. They want and will respond to fast, easy, and relevant information.

Figure 1. Source: Energy Consumers Australia ‘Energy Consumer Sentiment Survey’ June 2021

Figure 1. Source: Energy Consumers Australia ‘Energy Consumer Sentiment Survey’ June 2021

Is this information enough to flick the switch?

More than 60% of households indicated that having a better understanding of their electricity usage and which appliance uses the most energy would help them reduce their electricity consumption. On top of this, 60% of consumers also felt confident that access to this information through smart meter apps or tools would help them reduce and manage their electricity consumption. This indicates that consumers are ready to take action once provided with the right information.

Trust and access to data

The information smart meters collect is not provided directly to consumers but is made available by their electricity retailer or a third-party service. So, to benefit from this expanded data, a consumer must first allow access to their smart meter (and to their data). How comfortable are consumers with this type of arrangement?

The ECSS Survey indicates that 31% of respondents would be willing to share their data, 36% would be willing but would have some concerns and 21% would not be willing for any of their data to be shared. The fact that the majority of consumers still have some concerns over sharing data is consistent with our findings elsewhere in the survey regarding levels of consumer trust -- only 52% of consumers trust energy companies to do the right thing by their customers.

The big picture

Qualitative research conducted by ECA has found that consumers are not only financially motivated to reduce their electricity but also believe there is a sense of shared responsibility to reduce consumption. For benefits to be realised individually and across the community, consumers need easy access to the right kinds of information.

In Victoria, the state with the highest proliferation of smart meters in Australia, ECSS data suggests that consumers generally spend less time compared to other states thinking about electricity usage. This indicates that the opportunities consumers have to take advantage of the data collected on electricity usage by their smart meter are currently limited or do not provide the information they are most interested in.

Smart meters offer plenty of potential benefits, both for consumers and for the system as a whole, but it’s clear from these findings that there is plenty of work to be done to win the trust of consumers and create tools and products for them that actually improve their lives by offering information in a way that is easily navigable and actionable. It is up to the energy industry to now listen to consumers and create new and innovative products and services so that the promise of smart metering – consumers who are better placed to make easy decisions that benefit themselves and the system – can be realised.