The name given to the Government’s price comparison website, Energy Made Easy, tells us there is something inherently difficult about navigating the energy market. Despite describing itself as a “price comparison website”, you’re hardly being asked to compare deals on price alone. Head to the site and you’ll be faced with choices about not just the overall annual price, but if you want pay on time discounts, no disconnection fees, the option to pay in person, a fixed contract, monthly billing, time of use plans, solar feed-in plans or GreenPower options. And that’s just to name a few. Go into the details and you’ll find plans that give you yearly memberships to Taronga Zoo, frequent flyer points, the chance to support a charity. The amount of choice can be overwhelming.

But as choices increase, consumers still prioritise price

The Australian Energy Regulator, in its State of the Energy Market Report, notes that the introduction of price caps and restrictions on discounts has meant retailers are increasingly differentiating their products through methods beyond just price.

In many ways, choice is good for consumers. Who wouldn’t want 10,000 bonus frequent flyer points just for switching on the lights? And for those unable to install solar on their homes, GreenPower plans offer an accessible way to throw support behind the transition to renewables.

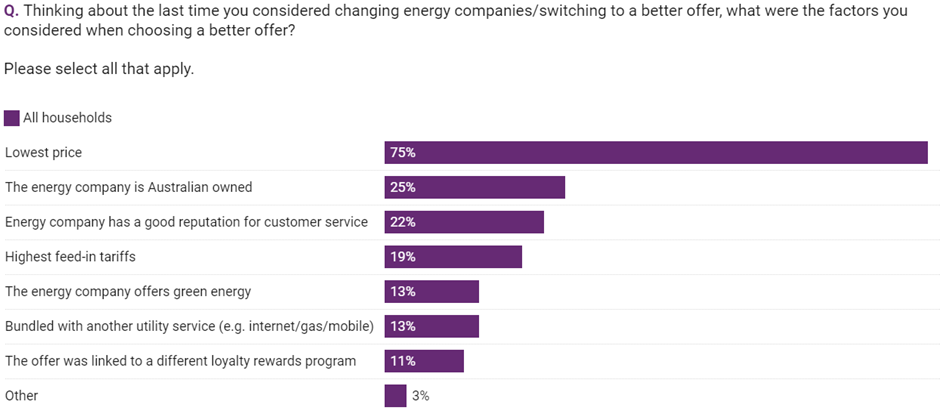

Our June 2023 Energy Consumer Sentiment Survey (ECSS) confirms that consumers are taking into consideration a number of factors beyond just price. In our latest ECSS, a quarter said they looked for an energy company that is Australian owned, while some wanted a company with a reputation for good customer service, and others indicated that feed-in tariffs, rewards programs, and green energy were all factors they considered.

But the data also show us that even as new and innovative plans emerge, price and affordability remain the top priority for consumers. Three quarters said they considered price the last time they were looking for an energy offer, significantly more than any other factor.

Increasing complexity is a barrier to choosing the best price

While consumers tell us they want an energy plan that gives them the lowest price, recent analysis from the ACCC found 79% of residential customers could be paying less if they switched to a better offer on Energy Made Easy, or Victoria’s alternative, Victorian Energy Compare.

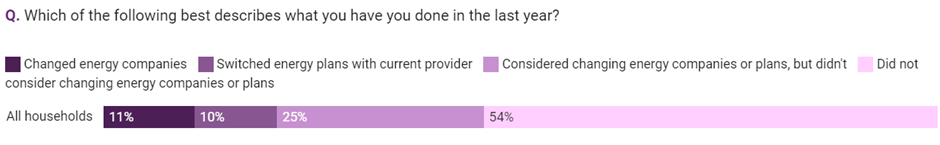

So why aren’t consumers on these better offers? The Australian Energy Regulator’s Towards Energy Equity Strategy identifies how a complex energy market has the potential to cause consumers harm and prevents consumers from acting in their own interests. Last year, despite record high energy prices, a cost-of-living crisis, and a ramping up of messaging from governments and industry encouraging consumers to switch; only one in five households said they had switched retailer or plan. But significantly, a further one in four said they had considered switching but decided against it, with many saying it was either too complicated, too time consuming, or too confusing.

The transition is driving further choice and complexity

Ron Ben-David outlines how new technologies, services, and business models emerging through the energy transition are increasing the number of variables consumers have to consider when making decisions about energy. Energy is no longer as simple as paying for the energy your house consumes from the grid. Our October 2023 Energy Consumer Behaviour Survey tells us over a third of households own rooftop solar and around a quarter say they would consider purchasing a battery storage system in the future. Consumers are becoming increasingly diverse in how they access and use energy. That brings a whole host of decisions about choosing technologies, how you plan on using them, and how you want it to be controlled.

In response to this, or perhaps enabling this, are a multitude of diverse offers and plans currently available on the market. For example, AGL gives solar battery owners the opportunity to sign up to their Virtual Power Plant and share their battery’s power in exchange for bill credits. Reposit promises you no bills for seven years when you purchase their Reposit Smart Controller, solar, batteries and inverters. And there are plans specifically for electric vehicle (EV) owners offering cheaper energy for nighttime charging. These kinds of plans and services require consumers to make complicated decisions about how they power their homes, and this will only become more prevalent going forward.

Existing tools aren’t enough to help consumers navigate a complex energy market

There are a couple of tools out there specifically aimed at helping consumers navigate the dozens of separate offers and retailers available to them. Energy Made Easy is one. The other main tool put forward as a way for consumers to compare offers easily is the reference price, which is the regulated standing offer price in their area (the Default Market Offer or the Victorian Default Offer). In theory, it allows consumers to compare between retailers and view which plan offers the greatest percentage discount off the reference price.

Both of these are designed for consumers wanting a traditional plan that offers energy from the grid at a reasonable price. Energy Made Easy has a hard time comparing anything that doesn’t fit into its narrow definition of 'best offer'. Variables like loyalty programs or customer service aren’t part of this. Innovative offers like Reposit’s won’t even make it to the list of possible options, let alone help you compare them. And the reference price, which is structured off a simple offer, also won’t help you there.

Consumers need help understanding where they may benefit from these more innovative plans, but also, where the risks might lie. Are they being asked to hand over control of how they use their consumer energy resources (CER) to their energy company? Will their offer charge them more if they use energy at certain times? Does the new, innovative product they are signing up for offer them access to dispute resolution if something goes wrong? Victoria’s Energy and Water Ombudsman, for example, reports that around one in five complaints they receive from solar customers are not in their jurisdiction.

The solution needs to think bigger and broader than what we have now. Elsewhere in the world, we are seeing countries develop one-stop-shops for consumers to access energy information. You can read more about why we think Australia should be following a similar path here.

Consumers who can’t engage with increased complexity need protection

Consumers who are willing and able to engage with this increased complexity may benefit from it, like electric vehicle (EV) owners wanting an EV-specific plan. But we also need to acknowledge that most consumers are not engaging with the energy market and increasing complexity will make engaging even harder.

The Default Market Offer (DMO), or the Victorian Default Offer (VDO) in Victoria, were introduced in 2019 specifically to protect disengaged consumers from being charged unreasonably high prices from their retailers. And while it’s been effective at capping the price a retailer can charge its standing offer customers, less than 10% of residential customers are on these types of offers. The rest are on market offers, which retailers are free to price how they want. The ACCC found that almost half of residential customers were paying prices that were equal to or above the DMO in its December 2023 report. Even more concerningly, 42% of concession customers were paying equal to or above it.

Retailers regularly move customers onto offers that are higher than the Default Market Offer once their market contract ends. That’s why we strongly believe that the onus should not be on people to have to switch at that point, it should be on retailers to do the right thing and not charge a loyalty tax, particularly when most customers aren’t really aware it’s happening.

As we head into the sixth year of the DMO and VDO, and with clear evidence of the number of consumers being charged above it, it’s about time we had a broader think about what we can do to ensure it fulfils its original intention, to protect consumers from unreasonable prices.

The energy market is changing rapidly. For some, this will offer up enormous opportunity, but they'll need help to navigate it and understand where the risks may lie. For others, this increasing complexity makes engagement with the energy market even less accessible or appealing. Both cohorts need access to an essential service at an affordable and fair price, but the tools on offer right now are growing increasingly obsolete. We need to consider how we can restock our toolbox to ensure that consumers have what they need to make optimal energy decisions that benefit them.