Recently, there has been much public discussion on the future of fossil gas in Australia and the consequences of potential declining gas demand.

In the past two months alone, the Grattan Institute has argued that gas should be phased out of homes and small businesses and called on governments to ban new gas connections. The Australian Energy Regulator (AER) also released a consultation paper to discuss how gas networks can recover costs given amendments to the National Energy Objectives to include emissions reductions targets and jurisdictional policies to encourage gas customers to transition to electricity.

It is encouraging that these public discussions are occurring as climate change and declining domestic gas demand will have material impacts on consumers. Policymakers should consider these issues and plan for the future of gas – whatever that future is.

With the need for policymakers to plan for an uncertain future, we pause to ask – if there is to be a major transition away from the use of gas in homes, when might this occur? Is this a future we could see any time soon?

Last week, the AER released their latest retail data for the energy market covering the March Quarter 2023. This data reveals a recent trend towards slowing in residential gas customer number growth. Looking forward, factors are emerging that could see residential gas customer number growth drop further. These factors include slowed development approval and construction rates.

While consumers have historically not considered disconnecting from the gas network, community-led initiatives are beginning to emerge, potentially signposting a major shift in consumer sentiment towards the use of fossil gas in their homes. If this shift is indeed underway, gas disconnection rates may start to exceed connection growth, resulting in net customer number declines sooner than many would have expected.

Policymakers need to formally monitor these trends and begin planning for the possibility of declining gas customers now.

Residential retail gas customer growth has declined significantly

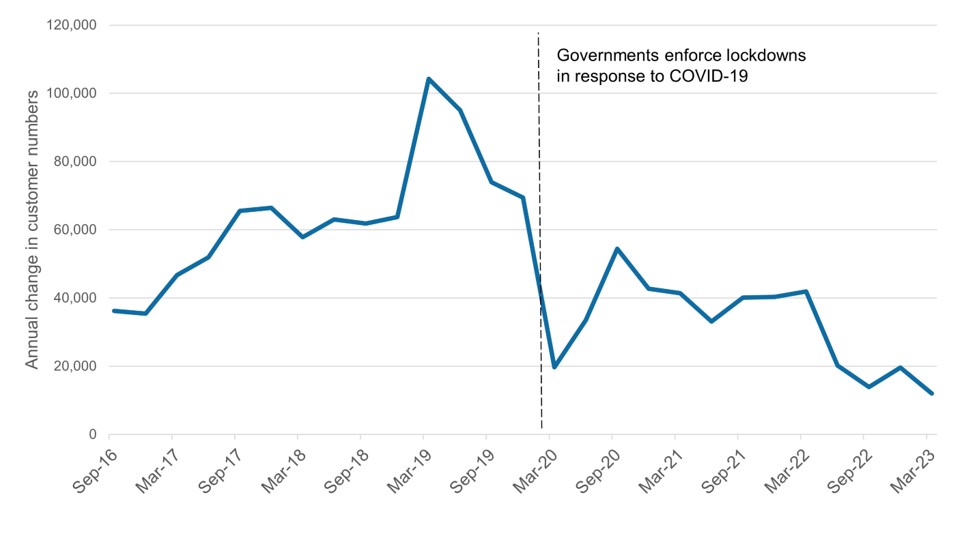

The AER’s data shows that compared with March Quarter 2022, there were around 12,000 additional residential retail gas customers in March Quarter 2023 (these figures cover NSW, ACT, QLD and SA). This was the lowest annual change on record, even lower than the increase recorded in the year to the COVID-19 lockdown affected March Quarter 2020.

In the past four quarters, the average annual residential gas customer growth rate has been around 16,000 customers. This is significantly below the average pre-COVID of around 64,000 additional customers per year (September Quarter 2016 to December Quarter 2019).

Annual change in residential gas customer numbers in NSW, ACT, QLD and SA - September Quarter 2016 to March Quarter 2023

Note: The AER does not collect data on gas customer numbers in Victoria. Source: Analysis of Performance Reporting.

While residential electricity customer growth has also slowed post COVID-19, the rate of decline has been larger for gas customers than electricity customers. Before March Quarter 2020, for every additional gas customer, there were on average 1.8 additional residential electricity customers for every additional residential gas customer. In the most recent four quarters there were on average 4.4 additional residential electricity customers for every additional residential gas customer.

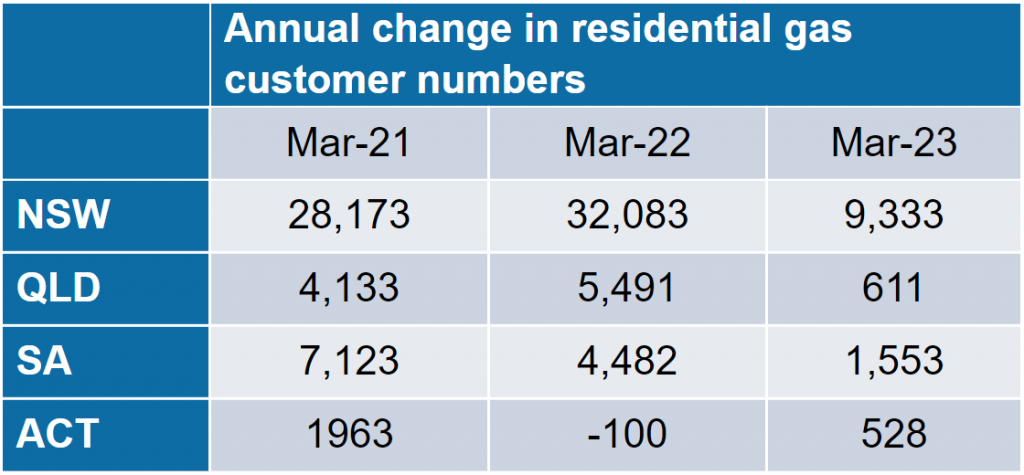

Slowed residential gas customer growth appears to be happening in each jurisdiction

NSW, ACT, QLD, and SA have all seen material declines in residential gas customer growth in recent years. Most notable is the ACT which has only seen 428 new residential gas customers since March Quarter 2021. In contrast, there were over 9,000 new residential electricity customers in ACT in that same period.

Source: Analysis of Performance Reporting.

Residential gas number growth could further slow in the coming year

Factors are emerging that could lead to even slower rates of residential customer number growth in the coming year.

Housing construction has slowed sharply

The largest driver of the recent decline in residential gas customer growth was likely the slowing of construction of new houses due to increasing costs and other economic factors. Evidence suggests this will likely continue over the coming year, potentially decreasing further.

In March 2023, the Australian Bureau of Statistics announced that private house approvals had hit a 10-year low. Analysis by KPMG has found that of the housing projects that have received approval, many are being delayed because of increasing construction costs.

Governments are introducing policies to transition away from gas

Several jurisdictions are introducing policies to support the transition away from gas. In August 2022, the ACT Government announced it will phase out fossil fuel gas by 2045 through electrification. The ACT Government is currently consulting on plans to prevent new gas network connections being made to new buildings from November 2023.

In 2022, the Victorian Government released its Gas Substitution Roadmap promoting electrification as a solution to reducing bills and carbon emissions in the state. The Victorian Government has stated that it is currently updating its Roadmap. However, the Victorian Government is yet to release any details.

Some developers are building all electric homes creating viable alternatives

Even in the absence of formal Government policy, building developers are emerging that offer all electric homes to match consumer appetite. For example,

- Preston Place is a new development in the inner north of Melbourne. It is advertised as having no gas connections.

- Arden Homes promote themselves as being all electric.

If consumer electrification sentiment changes quickly, residential gas customer numbers may decline

The October 2022 Energy Consumer Behaviour Survey found that only a small proportion of households were considering electrifying their homes at the time. Only 9% of households with a gas connection said they had seriously considered converting their home to electricity only, with 65% saying they hadn’t given it any thought at all.

While there is still some way to go for broad acceptance amongst Australian households, factors are emerging that are driving the retrofitting of existing homes to all electric. We are seeing many small pockets of community initiatives rise and receive prominence. For example, Electrify 2515, led by Saul Griffiths, is aiming to create one of Australia’s first all-electric communities. Many councils are also now openly encouraging electrification, such as Brimbank Council, City of Yarra and Merri Bek.

Residential consumers choosing to make their homes all-electric will likely result in requests to disconnect from the gas network. If these disconnection rates increase, and connection rates continue to decrease, then gas customer numbers would resultingly start to decline. Needless to say, if residential gas customer numbers begin to decline, residential gas demand will also decline.

Policymakers need to plan now for the possibility of declining gas customer numbers

The potential for declining gas demand poses a number of risks to the remaining gas customers. In a report (PDF, 1.02MB) commissioned by Energy Consumers Australia, Boardroom Energy recently outlined these risks. They found:

- As some customers disconnect from gas, the remaining customers will face progressively higher bills through higher network costs. Rising gas bills could prompt more consumers to switch, creating a self-reinforcing effect.

- If a large number of customers leave the network, switching to a renewable gas supply may no longer be an option.

- Switching from gas to an all-electric home may save households money. But this will depend on the abolishment fee, and/or the costs required to upgrade their electrical supply and related appliances.

- Some consumers will face barriers to switching. These are renters, low-income households, CALD customers, apartment dwellers and some businesses for whom alternative technologies are not yet viable.

Noting these risks, policymakers must begin planning now. These discussions should be informed by the evidence – disconnection inquiries, requests and associated costs – to ensure robust decision making. These are not discussions that we can afford to delay any longer. We must start talking seriously and planning in earnest for a future with decreased residential and small business fossil fuel gas demand.