How much consumers are charged for electricity has been understandably occupying daily headlines of late, but how they are charged is critical too, and is not being discussed or explored nearly enough.

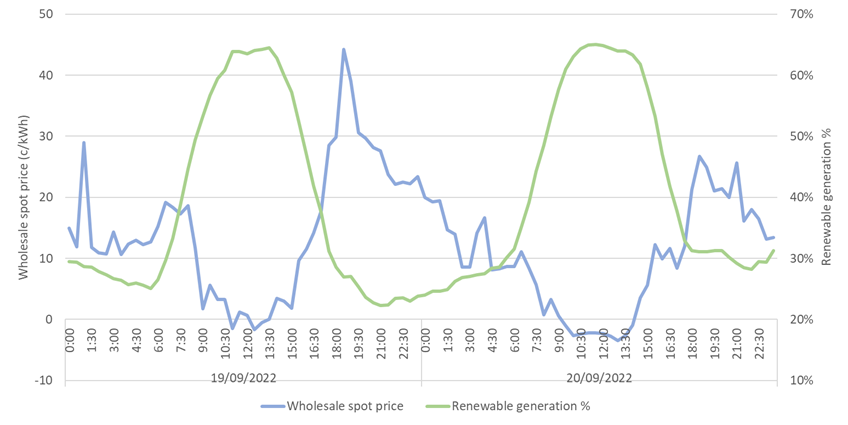

An influx of rooftop and large-scale solar generation – part of Australia’s renewable energy success story – means that energy is cheap and abundant during the middle of the day.

30-minute NEM average wholesale spot price and renewable contribution to generation during September - source OpenNEM

Many have therefore called for reform in the direction of cost-reflective retail pricing. In theory, a transition to cost-reflective retail pricing should incentivise consumers to make behaviour changes that more efficiently use the existing resources in our energy system, reducing the need for additional generation and infrastructure in the future.

And that should make energy cheaper for everyone as we transition to a renewables-dominated grid.

But progress towards such retail pricing reform has been slow. One obvious reason is the pace of the smart meter rollout – which will likely be accelerated in the coming years.

But what other reasons are there for a lack of progress in this area?

What will the future of retail pricing look like and how might we get there?

And what is the relationship between network tariff reform, where we have seen some significant progress and retail pricing – where we have seen less?

To build an evidence base in response to these questions, ECA and Econalytics undertook interviews with network and retail pricing managers to better understand the ‘state of play’ of current, new, and forthcoming network tariffs and retail prices. We also sought views on perceived barriers to change and potential consumer risks to understand how to better enable a consumer-focussed retail pricing transition.

Some of our key findings are discussed below. The full report can be found here.

What we heard

Overall, all respondents viewed retail pricing reform as being necessary to enable the energy transition. However, we observed differing views about the role of the network and the retailer in delivering the reform and some called for a clearer unified approach to reform. We also heard concerns that retail pricing reform might cause the energy divide to increase.

Does the consumer or the retailer receive the network tariff signals?

Why aren’t cost reflective changes to the tariffs networks charge retailers flowing through to the tariffs retailers offer to consumers? Maybe it’s a case of unclear intent. Our interviews identified that some networks viewed their tariff signals as being for the consumer, while others viewed their signals as being designed for the retailer (or technology).

Those who viewed their signals as going to the consumer designed their tariff structures intending them to be reflected in the consumer’s retail offer. Those who viewed their signals as intended for the retailer designed them to encourage the retailer to opt-in to more cost-reflective structures but were agnostic to whether these structures were reflected in the consumer’s retail offer.

These different philosophies reflect differing approaches to network tariff reform.

A need for consistency and stability in network approaches to tariff reform

Most retailers thought the future required an evolution in retail pricing. However, they said that the lack of consistency and stability in approaches by networks was a barrier to achieving this.

We heard:

- the inconsistency in tariff structures and peak periods across the networks made it difficult to create products and share information to help consumers benefit from the changes.

- because network tariffs are evolving and changing every five years, there was uncertainty over the duration of specific tariffs, making it difficult to invest in new products.

The need for a unified strategy to retail pricing reform

There was also feedback that the lack of a clear unified strategy from regulators and government was a barrier. Networks are being told to be more cost-reflective in their network tariff structures. On the other hand, retailers are being told that they must keep retail bills simple to ensure consumers can easily understand and compare products. This appeared to be a contradiction and made it difficult for retailers to determine what was expected from them.

Many consumers do not like or understand complex structures

Some retailers said they weren’t transitioning consumers to cost-reflective pricing structures because a large proportion of consumers don’t like such structures. Retailers mentioned that they have tried to transition consumers to cost-reflective structures in the past, but this resulted in a large number of complaints.

They also reported that energy literacy was relatively low, particularly for vulnerable consumers. In their view, many consumers do not understand how such pricing structures work and how their behaviour determines how much their final bill is. This meant they did not feel comfortable offering these consumers such pricing structures.

We particularly received strong feedback from retailers that consumers do not like and do not understand demand-based price structures. Many retailers told us they would aim to never offer such structures to consumers.

Retailers are adopting different approaches to deal with changing network tariffs

In response to the changing network tariff landscape, we heard that retailers were using different approaches:

- Some retailers said that the structure of their retail offer aligned with the structure of the network tariff.

- However, others said they intend to preserve flat prices, regardless of the network tariff.

Overall, there was a unanimous sentiment that as underlying network tariffs become more complex, retailers will have less ability to keep consumers on simple price structures. Many said they expect they will have to shift consumers to cost-reflective price structures in the future and were worried about the impact of this on vulnerable consumers.

What is the role of the retailer in the future? And what does this mean for the network?

Some viewed the role of the future retailer as being unchanged from what it is now. These respondents thought pricing reform should happen only at the network level, and retailers should pass on these cost-reflective signals. Because the network’s signals are being passed on to the consumer, network tariff reform needed to be done with this flow-through in mind and tariff structures should not be too complex.

Others said that they viewed the retail market as changing because of advances in automation technology. New products, enabled through complex network tariff structures, use controlled load to respond to dynamic price signals to provide customer savings. This line of thinking meant that complex network tariff structures were encouraged as they allow the retailer to provide a greater value proposition, while keeping the consumer on a simple pricing structure.

Technology will increase the energy divide

There was also a concern that technology-driven solutions could increase the energy divide. Those with their own home and high incomes would likely be able to access automation and/or consumer energy resources and could therefore benefit from the transition. However, those without access would be faced with either highly-complex retail price structures that they do not understand, or overly-high flat retail rates that leave them paying more than they should. None of the interviewees had any suggestions as to how to deal with this issue but mentioned the government will likely have a role in protecting vulnerable consumers during the transition.

What these insights tell us

This feedback tells us that if we want consumer-focussed retail pricing reform, we must agree on what retail pricing outcomes we want, and then work across the sector to identify measures that can deliver those outcomes.

Our interviews told us that change is coming, and technological advances can lead to further progress. However, not all consumers will be able to participate in this technology-driven transformation.

A consumer-focussed solution to retail pricing reform will be required to ensure all consumers are willing participants in the transition and to protect the many who are unable to easily participate. Such a solution would recognise that load flexibility does not have to mean all of the people, all of the time, for all of their load. Instead, the solution can be understood as for some people, some of the time, for some of their load.

We must also recognise that such reform will inevitably cause costs to consumers, notably increased complexity for a market that is already difficult for many consumers to navigate. This makes consistency and stability approaches important, allowing consumers time to learn about the changes and share knowledge across jurisdictions and networks.

Consumers who wish to remain on simple retail pricing structures should be able to. If consumers overwhelmingly do not like and understand demand price structures, they should not be assigned them. This may require changes in approaches by networks and retailers to ensure that this does not happen.

Where network tariffs have been designed with the consumer in mind, retailers should incorporate these into their prices. This will be particularly important as Consumer Energy Resources (CER) penetration (particularly EV load) rises and the need for demand-side participation increases.

Networks will also have a role in allowing retailers to provide to consumers products that reward them for their flexibility. Hopefully, due to innovations in tariff and pricing reform, the benefits to a consumer from being on a more cost-reflective rate will be so high that they seek out these offers anyway. But to ensure social licence and trust, this must be a decision made by the consumer, rather than one the industry forces onto them.

In conclusion, agency, trust, cooperation and the understanding that not all consumers will be able to participate in the transition will be key to enable successful retail pricing reform. We are encouraged to see that this is happening and look forward to seeing consumer-focussed retail pricing reform develop over the coming years.